Target Date Funds-- An Easy Way to Invest

Have you ever asked yourself, how should I be investing the money in my retirement account? A lot of people have this same question. One answer to this question is through a target date fund.

What is a target date fund?

A target date fund is a mix of investments that automatically adjust over time to help make sure you have a diversified portfolio.

How does a target date fund work?

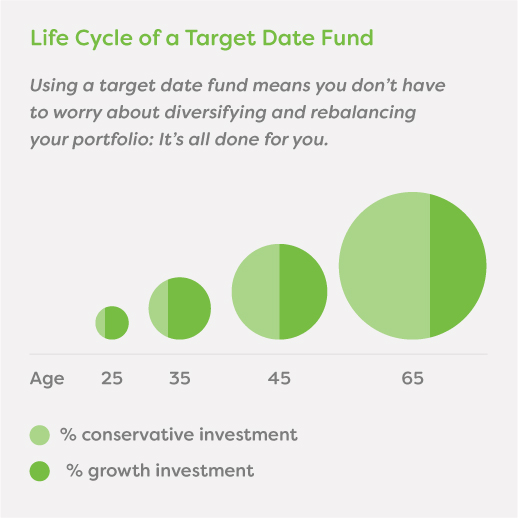

Let’s say you plan to retire around 2035, you would choose a target date fund with that target date. The asset mix will start out more heavily weighted in stocks, then gradually shift toward a more conservative allocation as retirement draws near. This is called a "glide path," where the percentage of stocks, bonds and other investments adjust as the fund approaches its target date. The glide path is typically managed by a professional money manager.

Because a target date fund is a mix of funds, you only need to have one target date fund to have a diversified portfolio.

Target date funds are named with a year at the end of the name. The year corresponds to the approximate year you plan to retire.

For example:

BlackRock LifePath Index 2035

BlackRock is the name of a professional money manager

LifePath is the name of the fund

2035 is the target year

Is a target date fund right for you?

A target date fund is a good option for people who don't have the time, expertise, or interest in managing all of their investments in their portfolio. A target date fund is a mix of funds that is professionally managed so you don't have to worry about maintaining a diversified portfolio.

If, however, you are the kind of person who likes researching and managing all of the investments in your portfolio, then a target date fund might not be a good choice for you.