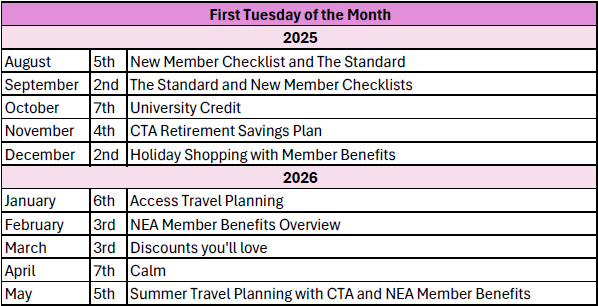

Member Benefits 4 You (MB4U)

Join CTA Member Benefits every first Tuesday of the month, 4 pm PST, to learn about your member benefits.

To register for MB4U sessions, click here.

Here's a schedule of the topics we will be covering each month. Can't wait to see you there!

Other Webinar Sessions

"Generation Debt: Student Loan Forgiveness"

Suffice it to say with the SAVE Plan tied up in litigation, the election of a new Administration, and potential changes to the US Department of Education, student loans, are top of mind for many educators. CTA Member Benefits is here to share the most current information, help answer questions, explain the loan forgiveness programs, and introduce the NEA Student Debt Navigator powered by Savi, which will analyze members student loans and help facilitate the process of making qualifying payments. By attending this session, members will have a better understanding of the process of forgiveness, paperwork to be filed, and how to advocate for themselves to the loan servicers.

Wednesday September 24, 2025 4:30-5:30 PM

Wednesday October 22, 2025 4:30-5:30 PM

Wednesday November 12, 2025 4:30-5:30 PM

Thursday December 18, 2025 4:30-5:30 PM

Thursday January 15, 2026 4:30-5:30 PM

Tuesday February 17, 2026 4:30-5:30 PM

Wednesday March 25, 2026 4:30-5:30 PM

Thursday April 16, 2026 4:30-5:30 PM

Wednesday May 6, 2026 4:30-5:30 PM

RSVP to any of the above sessions HERE!

“More Month Than Money: Setting and Living Within a Budget”

If you set a goal to get your finances in order, this session is one you won’t want to miss. We’ll focus on setting financial goals, learning about various investment vehicles, tracking daily expenditures, creating a cash flow statement, and establishing a budget. Throughout our discussion, we’ll highlight many CTA and NEA Member Benefits designed specifically with CTA Members in mind to help stretch your dollar. CTA Members will leave feeling confident with steps to get their finances on track.

“Retirement 101: Where do I even begin?”

You know planning for retirement is important…however, you don’t know where to begin, money is tight, you might be too busy, you have lesson plans to prepare, or maybe you hope to win the lottery. CTA Member Benefits can’t help you with lesson plans (and the lottery’s a gamble), but by attending this session, you’ll leave with a better understanding of retirement concepts, how to design your retirement plan, and be introduced to the CTA 403(b) Retirement Savings Plan. Plan Fiduciaries will explain how to open and fund a 403(b) to make sure you’re fully prepared for a financially secure retirement.

The Standard (August 2024)

---

CTA Retirement Savings Plan (September 2024)

---

University Credit Program (October 2024)

---

California Casualty (November 2024)

---

Access to Savings & Enterprise (December 2024)

---

CTA Calm Subscription (January 2024)

---

CTA Disaster Relief Fund (February 2024)

---

Provident Credit Union (May 2024)

---