The Downsides of Taking a Loan or Borrowing From Your Retirement Account

Don't shortchange your retirement security by dipping into your retirement savings.

For many of us, it’s easy to look at our retirement savings and to think we could better use this money for immediate needs. But there can be serious negative consequences to taking money out of your retirement account. Let’s look at a few.

Taxes & penalties

If you cash out a 403(b) plan, you’ll owe taxes on the total distribution, and a 10% tax penalty may be assessed if you're younger than 59 (or 55 if separated from employment). That's a hefty hit on your savings. For example, with a $10,000 balance, an educator who is in the 25% federal income tax bracket would owe $3,500 in taxes, (and penalties if applicable) leaving only $6,500.

If you have a 457 plan, you’ll owe taxes, but not a 10% penalty on a lump-sum distribution. However, your district is required to withhold 20% of the balance for tax purposes, which costs you a loss of future growth and earnings. But remember, you can’t cash your 457 while employed.

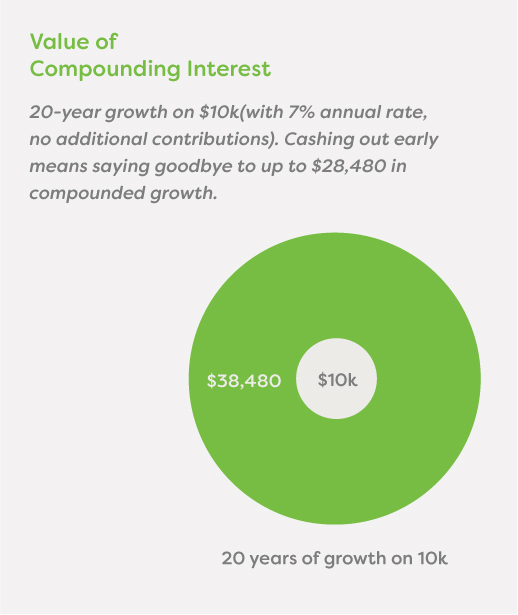

Compounding interest

You’ll lose future tax-deferred compounding interest which is the addition of interest to the principal sum of a loan or deposit. Basically, it’s interest on interest. For example, if you leave your savings undisturbed and it earns a 7% annual rate, that $10,000 could grow to $38,500 after 20 years with no additional contributions.** If you cash out of your plan, you could be saying goodbye to more than $28,000 in compounded growth.

Deferred retirement date

* Taxes will be due at ordinary income tax rates upon withdrawal from a 403(b) or 457 plan. Premature withdrawals (generally, those made before age 59½) may be subject to a 10% tax penalty, too (does not apply to 457 plans).

** Rate of return is for illustration only and does not represent the return of any specific investment. Your returns will vary.