Leaving your current employer?

Job change is a good time to think about your retirement savings, you'll need to make some important decisions about your retirement savings.

Your retirement plan is a critical part of your financial well-being. When you leave your employer, you should make sure that your plan remains intact. You have options, let's review what they are.

Transfer your funds to an Individual Retirement Account (IRA)

When you transfer your retirement savings from your former employer to an IRA this is called rolling over your account. You can rollover a 403(b) or 457 plan into an IRA. With an IRA, you’ll have many more investment options and flexibility than with your employers’ plan. You can also make contributions to your IRA in addition to the funds you roll over.

You’ll need to decide where to open your IRA account,

There IRA marketplace is filled with hundreds of companies offering IRA’s high fees, hidden fees and other sub-optimal features, this will require some homework to find the administrator that is right for you.

Here are some things to think about when opening an IRA

- Decide where to open your account, this will be the company that administers your plan.

- Find out about fees on the account including administrative fees, advisory fees, custodial fees, investment management fees and requirements for minimum balances.

Initiating your rollover

You will need to contact your current plan administrator to start the roll over process, they will advise you as to the steps involved in processing your roll over.

Be sure your district transfers your balance directly into an IRA. If the distribution is made to you first, the plan must withhold 20% for federal withholding taxes. Then, you’ll need to come up with another 20% from other sources to equal your full roll over amount and deposit it in an IRA within 60 days or it will be considered a distribution. In that case, you’ll then be taxed on the entire amount at ordinary income tax rates, and may owe a 10% tax penalty if you are younger than age 55 and have separated from work. Avoid this situation if at all possible.

Transfer to your new employer’s plan

If your new employer offers a 403(b) or 457 plan, you may be able to transfer your old plan’s funds to your new plan. Check with your new plan’s administrator for details.

If you have more than one retirement plan from changing jobs and employers, be sure not to lose track of them. You may even want to consider consolidating them all into one plan for easier management.

Keep your plan where it is—with your former employer

As long as you have at least $5,000 in your account, it’s likely you’ll be able to remain within your former employer’s 403(b) or 457 plan. This may be a good option if you’re satisfied with your plan’s fund choices, and hesitant to shift your funds elsewhere. One big reason to keep your savings with a former employer is if they have high quality low-fee investment funds available. Often times employer can get better pricing than if you were to go out and get a new plan on your own.

If all or part of your balance is in an annuity that would result in substantial surrender fees if you take it out, you may want to consider leaving the money in your current 403(b) or 457 plan.

Cashing out your plan

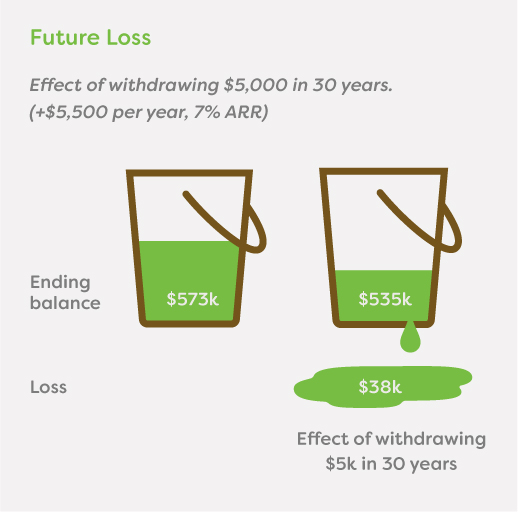

The worst decision you can make is to cash out your retirement plan, it will cost definitely cost you in the future. You will pay penalties and taxes and your money will no longer have the potential for growth, an important consideration if your retirement is many years away.