Overview of Retirement Benefits

Understanding your retirement benefits will help you make important decisions about your finances.

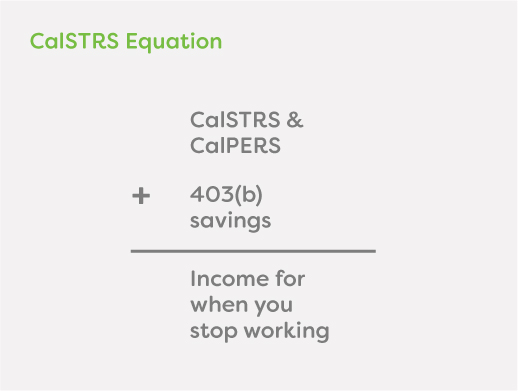

When you retire, you'll need income. For most educators, retirement income will come from savings and pension.

Plan on your pension

As an educator in the State of California, you pay into CalSTRS/CalPERS, which is a pension.

Both CalSTRS and CalPERS are traditional defined benefit plans that provide retirement, disability, and survivor benefits. Your retirement benefit is based on a formula set by law, so you'll want to make sure to understand how it is calculated.

It is also important to note that your pension will not cover 100% of the income you need to live on in retirement. Your benefit is calculated by years of service and other factors. The essential thing to know is that for most people, their pension will cover only about 50% to 65% of the income they will need in retirement.

Personal savings

To help make sure you have enough income to live on in retirement, it is important to start a personal retirement savings plan, such as a 403(b).

CTA has developed a retirement savings plan to help ensure that educators have access to a high-quality, low-cost retirement savings plan. There are many savings plans you can use, but many have high fees, surrender charges, and commissions.

The CTA retirement savings plan has none of these costs and many advantages.