Tax Benefits of 403(b) and 457 Plans

When you save through your 403(b) or 457 plan, you have two important tax-saving benefits: pre-tax contributions and tax-deferred growth.

Let’s take a closer look at these two options and what they mean for your future retirement goals.

What is a pre-tax contribution?

Any contribution made to a retirement account before taxes are deducted. For example, let’s say you earn $75,000 this year and you put $10,000 into your retirement account. Rather than paying income taxes on $75,000, you’ll pay taxes only on $65,000. Contributing to a pre-tax retirement account actually reduces the amount you’ll owe this year in taxes. However, you will have to pay taxes when you take the money out of your retirement plan.

What is a post-tax contribution?

Any contribution made to a retirement account after taxes have been deducted from an individual’s taxable income. Simply put, this is money that goes into your retirement account after taxes have been collected–your taxes don’t go down at all this year. The plus with post-tax contributions is that you don’t have to pay any taxes when you take the money out once you reach retirement age.

What is tax-deferred growth?

Any earnings in your retirement account–such as interest, dividends, and capital appreciation–remain in the account until you begin withdrawing money at retirement. You will have to pay taxes on the money once you start withdrawing it. However, you may have already benefited from many years of compounding interest. And there is a possibility that you will be in a lower tax bracket after you retire.

You can control the amount of money you withdraw from your 403(b) or 457 plan in retirement (subject to required minimum distributions), which allows you some control over your tax bill in retirement. Last, like pre-tax contributions, the benefit of a tax-deferred account is that taxes are deferred until withdrawal.

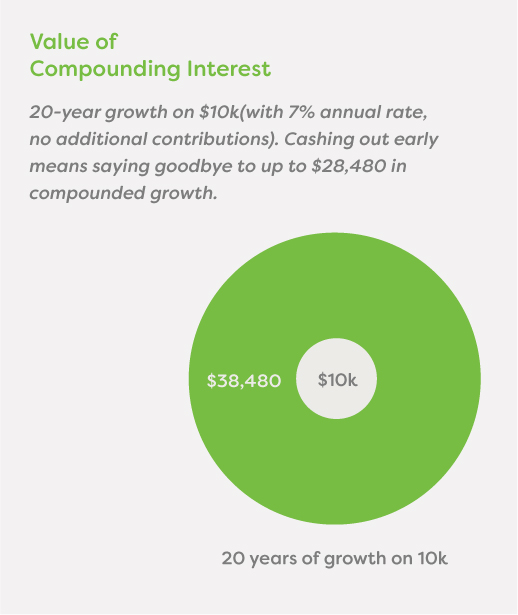

Value of compounding interest

Compounding interest is basically interest on interest. The value of pre-tax and tax-deferred contributions is that this money will continue to earn money for you, the longer you leave your contributions alone.

Taxes will be due upon withdrawal in a traditional 403(b) plan. Distributions before age 59 ½ (age 55 upon separation from service) may incur a 10% tax penalty. The 10% tax penalty does not apply to 457 plans.